Baltic startups raised €540M in the second half of 2023

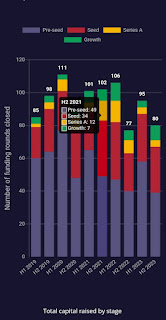

According to the Baltic Startup Funding Report, conducted by Lithuanian accelerator and VC Firstpick and Estonian Change Ventures, Baltic startups raised €540M in the second half of 2023. €425,65M was invested in nine growth companies. It is five times more capital raised by growth technology companies compared to H1 2023.

In the last six months of 2023, €14,63M was raised by Baltic startups and there were 39 pre-seed funding rounds (in H1 2023, there were 58 pre-seed funding rounds, and €22,77M was secured). In the second half of 2023, there were 28 seed rounds with €69,22M of investment (in H1 2023, 29 seed-stage startups raised €53,63M). In H2 2023, there were only four series A rounds with €30,7M. It is the same amount of the rounds as in H1 2023.

If to divide by countries, in the last six months of 2023 Estonia was the leading country in the Baltics, regarding the close of pre-seed, seed rounds, and series A. However, Lithuania overpassed Estonia regarding the number of growth round closures. In particular, only two Lithuanian growth technology companies: a developer of solar project design software PVCase and a provider of digital security and privacy solutions for individuals and businesses Nord Security raised €100M each.

In H2 2023, the median pre-seed round size of Baltic startups was estimated as €300K with the upper quartile €490K and the lower - €223K. Half of all pre-seed rounds were also pre-revenue rounds, meaning investors were ready to back companies at these stages without revenue.

The median seed round size in the Baltics has reached €2M with an upper quartile of €3,21M and lower - €913K. Median monthly revenue traction for seed-stage startups has risen to almost €50K, meaning that investors prioritized startups at these stages with serious traction. In the second half of 2023, the big gap between the upper and lower quartiles for both pre-seed and seed rounds was at the same level as in H1 2023.

The authors of the report noted that 2023 saw a rise in bridge and extension rounds. The amount of pre-seed rounds that were closed via convertible notes increased compared to equity investment rounds. Their number rose to 62% compared to 40% in 2022. Regarding seed rounds, in 2023, the number of equity closures fell from 69% in 2022 to 48%.

Established in Tallinn in 2017 by entrepreneurs Andris K. Berzins, Rait Ojasaar, and Yrjö Ojasaar, Change Ventures is a pre-seed/seed stage venture capital fund, that backs startups founded by Baltic entrepreneurs. It has invested in over 30 startups.

Established by an ex-Lithuanian team of Estonian accelerator StartupWiseGuys, a VC and an accelerator Firstpick supports mainly Baltic startups with the initial ticket of €50-€200K. The fund size is €20M. In 2024, it raised an undisclosed amount of investment from Vienna-based VC Speedinvest. The Managing Partners are Jonė Vaitulevičiūtė, Marijus Andrijauskas, Dmitrij Sosunov, and Andra Bagdonaite.